Disclosure: This page contains affiliate links. We may earn a commission if you sign up through our links—at no extra cost to you.

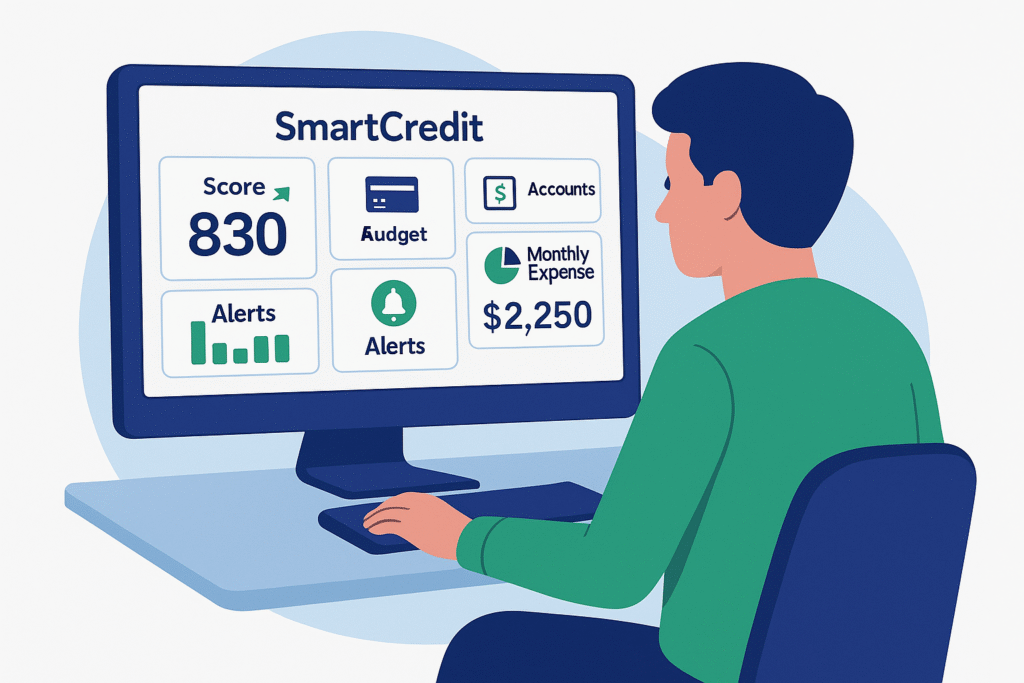

Updated for 2025. SmartCredit combines credit alerts with everyday money tools—budgets, spend tracking, and action lists—so you can spot issues and act quickly from one place.

Affiliate link — costs you nothing.

Why a unified dashboard wins

You can improve your credit score and still feel lost if spending, bills, and card balances live in different apps. SmartCredit merges credit alerts with daily money management so you can act fast—pay a bill, adjust a budget, or prioritize a debt—without juggling multiple tools.

What SmartCredit provides

- Credit & score tracking: monitoring across 1–3 bureaus (depending on your plan).

- Accounts & transactions: connect bank and card accounts (read-only) for a live money picture.

- Budgets & alerts: track spend vs plan and get alerted when you overshoot categories.

- Action tools: to-do lists, letter templates, and reminders to contact creditors or schedule payments.

- Score education: see how utilization, payment history, and inquiries influence your score.

Who should use it

- Anyone who wants credit + cash-flow in one view.

- People working a debt payoff plan or sticking to a monthly budget.

- New credit builders who benefit from nudges and a clear weekly routine.

Getting started (step by step)

- Create your account and enable 2FA.

- Connect financial accounts (read-only) and categorize spending.

- Add budget categories (rent, groceries, fuel, subscriptions).

- Review your credit snapshot: card utilization, any derogatories, recent inquiries.

- Turn on alerts for large transactions, due dates, and score changes.

- Add action items: disputes to file, balances to pay, calls to make.

Build a debt-priority plan

- Sort accounts by APR and balance.

- Choose a method: Avalanche (highest APR first) or Snowball (smallest balance first).

- Automate minimums, then add a focused extra payment to the target account.

- Track weekly from the dashboard—celebrate each paid-off line.

Use score signals the right way

Treat score changes as signals, not verdicts. If utilization spikes, pay it down before the statement closes. When rate-shopping, group your applications in a short window. Avoid opening extra accounts just to “game” your mix.

Pros & Cons

Pros: unified view of credit + spending; practical action tools that reduce procrastination; excellent for budgeting and debt payoff.

Cons: not a CRA (you still dispute with the bureaus); not an identity-recovery suite like LifeLock.

Pricing & plans

Plans vary by number of bureaus monitored and which money tools you unlock. Check current pricing on the official site.

Best pairings

- SmartCredit + credit freezes at the bureaus for security.

- Add Experian to view and dispute source data when needed.

- Add LifeLock if you want broader identity monitoring and recovery support. Or jump to our Detailed Comparison.

FAQ

Is SmartCredit a credit bureau? No. SmartCredit aggregates and tracks data; disputes go to the bureaus.

Will it help me budget? Yes—connect accounts, set categories, and track spend vs plan with alerts.

Can I see three-bureau data? Available on higher-tier plans; check current details.

Affiliate link — helps us keep this content free.